Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take two minutes to learn more.

This article is not intended to be financial, investment or trading advice. This article is for information and solely for education purposes. It does not protect against any financial loss, risk or fraud.

Cryptocurrency has had a rocky journey this year, with many of the top coins plummeting to record lows and several seismic events shaking the crypto community. In this article, we have summarised for you the current state of crypto and where crypto might be heading in the near future.

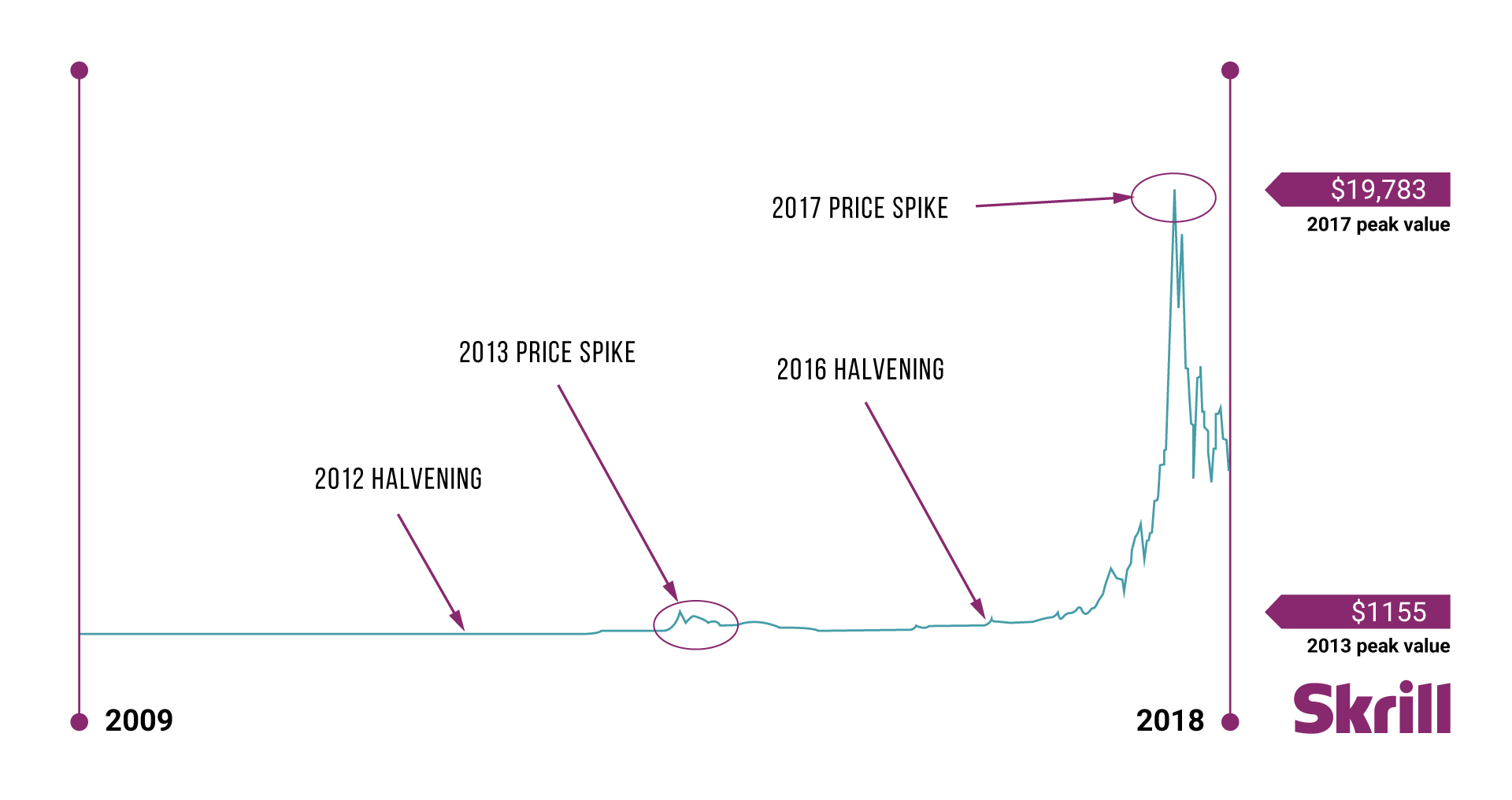

Being in a bear market currently, there is a range of perspectives that could explain it. Some attribute the softness being linked to the regular four-year Bitcoin-halving cycle, which has been demonstrated in the past with matching bear and bull markets. Others believe that macroeconomic weakness is the main contributor, as well as economic events outside of crypto.

This article is not intended to be financial, investment or trading advice. This article is for information and solely for educational purposes. It does not protect against any financial loss, risk or fraud.

Macro Environment:

In the current environment, there are three key factors that can cause both the traditional and crypto markets to struggle.

1. Rising cost of capital

Put simply, this is an increase in interest rates, which makes capital more expensive. It also raises the ‘risk-free rate’, which in finance is typically the US T-bill interest rate. If you take the three-month T-bill interest at the time of writing, it’s around 2.5% – a year ago it was 0.05%. The magnitude of this change cannot be overstated, this is 50x increase in a very short period. In financial markets it’s the change in the margin that matters most.

The Federal Reserve has committed to continue hiking interest rates to rein in inflation, this has a direct impact on the cost of capital. As we don’t know how much or how long this dynamic will continue, the uncertainty further deteriorates the outlook for risk assets.

2. Declining overall liquidity

There are numerous ways to measure global liquidity, each with different assumptions and influencing factors, but the direction of all of them are clear and is pointing north. This impacts all assets, particularly risk assets like cryptoassets. Raoul Paul published the chart below, illustrating the trend of M2 (the broad money supply that includes most cash and cash equivalents) and its correlation with crypto market cap:

3. High inflation

Prices across the globe have been rising at an accelerated pace, especially in the developed world. The two visuals below show the inflation trends in major economies and a picture of how the phenomenon is strong and widespread.

Where more money is needed for necessities, there’s less discretionary income and money for investments. Though some people view Bitcoin as a potential hedge against inflation, typically it leads to BTC price increases.

Generally, markets are forward-looking while price increases are a lagging indicator, therefore they reflect inflation expectations much in advance.

Overall, there are significant macro headwinds that the cryptocurrency asset class is facing. The combination of the rising cost of capital, inflation and geopolitical tensions has led to uncertainty looming over all financial markets. For example, the S&P 500, the benchmark investment index for the broad US stock market, has lost about 15% year to date. Cryptocurrency and Bitcoin are not immune to this trend. As per Kraken’s market intelligence, BTC correlation held roughly at 0.9 for both Nasdaq and S&P 500 since mid-May before decoupling in late July.

However, it’s important to note that markets and economies run in cycles. It’s likely we’re in the later innings of an increased inflation and liquidity tightening cycle, but it will eventually turn as it always has. With recessions on the horizon for all major world economies, monetary and fiscal conditions will likely need to start easing. When this happens, the crypto assets will ‘sniff’ the liquidity increase very quickly. Historically, uncertain times like these have been the best periods to enter the digital asset market with a long-term investment horizon.

Technical

From a technical perspective, Bitcoin is in a bear market but is looking like it wants to find a bottom. At the time of writing, Bitcoin is trading between its 200 weekly Simple Moving Average (SMA) and Exponential Moving Average (EMA), which equates to €22.9k and €26.7k respectively. These measures are widely used as industry benchmarks and have historically marked market cycle bottoms.

Recently, momentum has turned slightly, with indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) now in the neutral territory.

Ethereum, which is the proxy for the so-called ‘alt-coin’ market, is trading confidently above the weekly 200 MA’s on both its USD and BTC pair, but the correlation with Bitcoin will likely not allow ETH to rally, if Bitcoin struggles to gain ground.

From an overall volume perspective, as reported by the Block, the legitimate exchange volumes are down about 40 to 50% when comparing July 2022 to May 2021 and down 70% compared to the all-time highs.

Fundamental / On-Chain

In traditional investing fundamental analysis deals with determining a stock’s real or fair market value. Here, the term fundamental is used to distinguish from the technical indicators and recent price action to more underlying factors such as user growth, adoption, and on-chain activity. On-chain transactions are defined as transactions that occur on a blockchain, meaning they’re reflected on the distributed, public ledger.

At the highest level of the cryptocurrency space, we can examine user growth. One of the most famous charts compared the growth of the digital asset universe to the growth of the internet. The trend is clearly positive, with crypto being the fastest adoption of technology ever. Even if growth slows down to match that of the internet, it is likely that one billion crypto users will have been achieved before the end of the decade.

Bitcoin

For Bitcoin, the average number of transactions seems relatively steady, certainly much higher than the bear market of 2018, but at about half the value of the bull market in 2017 and 2020. The trend is very similar for the number of active Bitcoin addresses (data from The Block research).

It is also important to mention Bitcoin’s main layer 2, the lightning network, has been rapidly growing in capacity despite the bear market and that does take a load off the base layer as users prefer to use lightning for cheap and instant payments.

Ethereum

Ethereum’s network usage seems to be very healthy, and at almost all-time highs in number of daily transactions, active addresses and gas utilisation as shown by Etherscan.io.

Ethereum’s L2s has also been growing alongside the base layer. The total value locked there has grown to about €5.8bn at the time of writing from practically zero at the beginning of 2020.

NFT sales have cooled off significantly from their peaks but are still there even before any of the major blockchain-enabled games in development have gone live.

Though plenty of other on-chain metrics exist, focusing on users and utilisation provides an important perspective in terms of where the space is going. Fundamentally, especially for Bitcoin and Ethereum, things look healthy with only a slight pullback in a few metrics while others continue to grow.

Industry

The LUNA crash

The LUNA foundation was responsible for the creation of their own blockchain centred around the algorithmic stablecoin UST. At its peak, UST had a market cap of almost €20bn, which would put it fifth in today’s crypto market.

To support the 1:1 peg with the US dollar, the LUNA Foundation Guard acquired more than 80,000 Bitcoin, becoming the second largest entity holding crypto in reserves. As the peg began to break in May 2022, these 80,000 Bitcoin were sold on the market in the matter of days. For wider context, at the time of writing, the total 24h Bitcoin volume on Coinbase on the USD pair is about 24,000 Bitcoin. At the time of sale, the 80,000 BTC had a total value of about €3.5bn. As a result of the sale, Bitcoin lost about 30% of its value in May and the total cryptocurrency market cap dropped more than 40%. The direct and indirect losses from this collapse were huge across the industry and contagion risk was elevated. Direct losses from UST and LUNA is estimated at €60bn.

The Celcius bankruptcy

Following the LUNA crash, rumours of Celsius issues started spreading. There was some UST exposure in the company holdings, though it was clear from on-chain transactions that Celsius managed the situation well with minimal losses.

At its peak in Q4 2021, Celsius claimed to manage more than €25bn in assets making it the biggest player in the retail crypto banking space. They were paying out great interest on crypto holdings between 3-6% on BTC and ETH and close to double digits on stablecoins. All was going well on the “crypto app for the people” until more and more users continued withdrawing massive amounts for several weeks. The “bank run” culminated on June 12th, when Celsius announced it was halting withdrawals.

Crypto insiders had previously accused Celsius of rehypothecating funds and making risky uncollateralised loans to shady counterparties. Ultimately, what got them was their exposure to staked ETH, a liquid ETH2 interest-bearing derivative supported by Lido. Celsius relied on that product to provide a large portion of the ETH interest for customers. Before May 2021, the staked ETH used to trade pretty much on par with ETH, but once withdrawals increased, Celsius had to unwind their position quickly and at a discount to satisfy redemptions. In a big test for the liquidity and functioning of decentralised protocols like Curve and AAVE, Celsius had to bend the knee and respect their open and transparent rules.

In the end, Celsius had to declare bankruptcy, leaving a gap of more than €1.2bn hole the company’s balance sheet and thousands of depositors hoping to get at least some of their investment back. This caused marketwide panic and a massive selloff. Tether alone, the issuer behind USDT, which is still the largest stablecoin, liquidated Celsius on a loan of €900m.

Three Arrows Capital (3AC)

The 3AC crypto hedge fund had a big LUNA exposure, around €200m. As crypto prices were tanking, 3AC could not meet its credit obligations. To make things worse for the industry overall, 3AC had borrowed huge sums of money from practically all major institutional lenders in the space: BlockFi, Voyager Digital, Genesis to name a few. In some cases, they’d posted the same collateral multiple times. BlockFi survived with a little help from FTX, Genesis was able to absorb the losses, but Voyager Digital and Hodlonaut were forced to suspend withdrawals and filed for bankruptcy.

For smaller players in the industry, they didn’t manage to survive these series of events. The crypto-focused bank Nuri recently filed for bankruptcy, as did several Asian crypto exchanges and companies like Babel Finance and Zipmex. Rumours reached their peak when people speculated Coinbase was insolvent as they, like most companies in the crypto space, announced staff redundancies. According to Coindesk, 3,726 crypto jobs had been lost by July 21, 2022.

Despite this doom and gloom, all is not lost. The layoffs and bankruptcies are necessary to reduce the froth and leverage, filtering out good actors from bad, and transferring coins from the weak hands to the strong hands with a longer time horizon. This is what it takes to lay the foundation for stability and the next bull markets in years to come.

For example, large institutions continued to enter the crypto space during the downturn, such as JP Morgan and Citibank expanding their crypto staff and custody abilities to Blackrock, the world's biggest asset management firm with close to €9tn under management. Reddit also announced they’re launching their token in a partnership with FTX and Arbitrum.

Similarly, liquidity drying up across all financial markets hasn’t stopped investments in the crypto space. A recently published fundraising report by Messari calculated that €30.3bn was raised by crypto projects and startups in the first half of 2022. According to Bitcoin.com, the money was raised across 1,199 fundraising rounds and surpasses the funding of all blockchain startups and projects obtained in 2021.

It’s also important to acknowledge the major technical milestones necessary to move the industry forward, some of which are rapidly approaching. ‘The merge’, which marks the transition of Ethereum from proof of work to proof of stake, is arguably the biggest event in the crypto space since Ethereum’s launch in 2015.

Not only will it make Ethereum more environmentally sustainable but has economic implications as ETH will likely increase in scarcity, all the while providing a native source of yield in the crypto space. Though this comes with a lot of risks, it’s a major change to how the biggest smart contract platform works and something the community is committed to for the industry to move forward.

Overall, we have seen a tremendous period of volatility and deleveraging across all financial markets. This has heavily impacted the digital asset space and, coupled with some industry-specific events, has produced a brutal bear market. For example, Bitcoin had never fallen below its previous bull market high during the subsequent bear market. Whether the bottom is in, we can only speculate, but what is clear is that the industry has gone through a big round of cleansing. Once financial conditions start improving, companies reorganise and become more effective, roadmaps and tech improvements become realised, the asset class could exceed its previous valuations, as it’s still a tiny fraction of the financial market and growing at an astonishing pace. Ultimately, the fundamentals are there and crypto is not going away. Though times like these prove the most challenging to retain conviction, they can also present the biggest opportunities.

Try crypto with Skrill today

- Buy and sell over 40 different cryptocurrencies, now including Polkadot

- Set conditional orders to control your trading

- Earn points and be rewarded with Skrill's loyalty programme, Knect

Cryptocurrencies are unregulated in the UK. Capital Gains Tax or other taxes may apply. The value of investments is variable and can go down as well as up.